Review of Full-Year Financial Results

Fiscal Year Ended December 2025

With the rapid advancement of technologies led by the dramatic evolution of generative AI, digital transformation (DX) across all industries is expected to accelerate in both efficiency improvements and value creation. As the digital domain functions as an indispensable social infrastructure for social and economic activities, the use of social media has expanded beyond communication alone into areas such as payments and purchasing, further strengthening its influence. In addition, viewing of online content on internet-connected TVs is increasing, bringing changes to the way conventional devices are used, and consumer behavior and the media environment are becoming increasingly diverse and complex. In response to these environmental changes, the advertising industry is also facing increasing demand for marketing services that integrate online and offline channels while leveraging the characteristics of each medium, as well as for marketing support that utilizes data and AI.

In the Japanese advertising market in 2024, internet advertising expenditures reached ¥3,651.7 billion (109.6% year on year), accounting for 47.6% of total advertising expenditures (Dentsu Inc., “2024 Advertising Expenditures in Japan”), making the digital shift in corporate marketing activities increasingly pronounced.

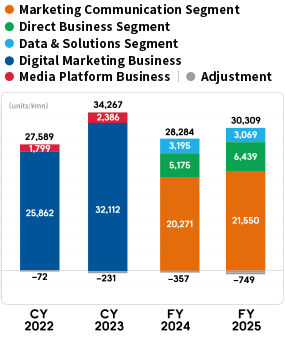

Under these circumstances, in the main Marketing Communication Segment, the Company expanded existing projects and acquired new ones, while also promoting the alliance with the Dentsu Group. In addition, the revenue uplift from initiatives aimed at addressing its short-term challenges of improving profitability absorbed higher SG&A expenses, resulting in increases in both revenue and Non-GAAP operating profit year on year. In the Direct Business Segment, both revenue and Non-GAAP operating profit increased, driven by significant revenue growth, primarily from offline advertising projects. In the Data & Solutions Segment, revenue and Non-GAAP operating profit declined due to the roll-off of certain projects delivered in the previous fiscal year and other factors.

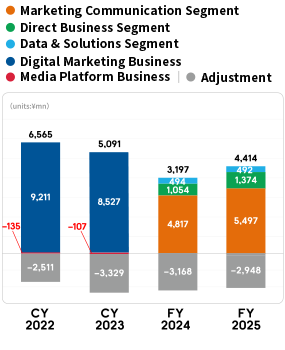

As a result, revenue was ¥30,309 million (up 7.2% year on year), operating profit was ¥4,239 million (up 35.4% year on year), Non-GAAP operating profit was ¥4,414 million (up 38.1% year on year), profit before tax was ¥4,718 million (down 3.1% year on year), profit was ¥3,490 million (down 36.8% year on year), and profit attributable to owners of parent was ¥3,491 million (down 36.8% year on year).

Overview of consolidated full-year financial results

(units:¥million)

| FY2022 | FY2023 | FY2024 | FY2025 | |

|---|---|---|---|---|

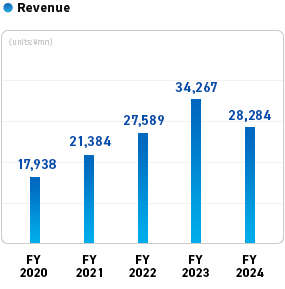

| Revenue | 27,589 | 34,267 | 28,284 | 30,309 |

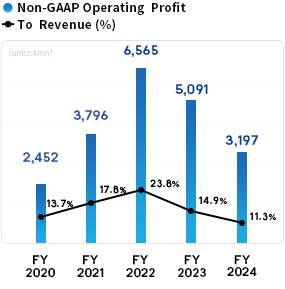

| Non-GAAP operating profit | 6,565 | 5,091 | 3,197 | 4,414 |

| Operating profit | 6,166 | 4,949 | 3,129 | 4,239 |

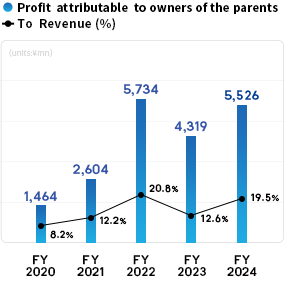

| Profit attributable to owners of parent | 5,734 | 4,319 | 5,526 | 3,491 |

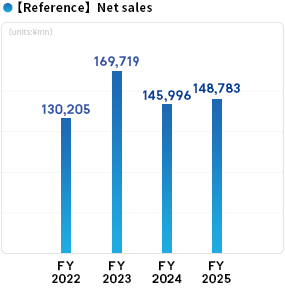

| 【Reference】Net sales | 130,205 | 169,719 | 145,996 | 148,783 |

| CY2022 | CY2023 | FY2024 | FY2025 | |

|---|---|---|---|---|

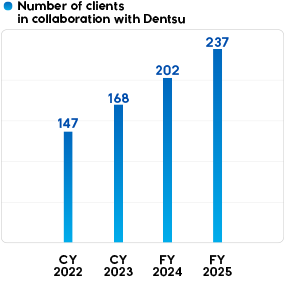

| Number of clients in collaboration with Dentsu | 147 | 168 | 202 | 237 |

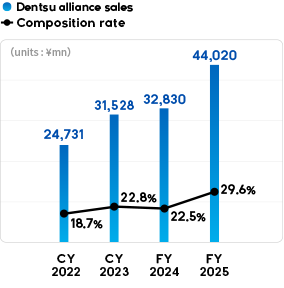

| Dentsu alliance sales | 24,762 | 31,718 | 32,830 | 44,020 |

The trend of consolidated full-year financial results

Financial results by segment

(units:¥million)

| FY2022 | FY2023 | FY2024 | FY2025 | ||

|---|---|---|---|---|---|

Revenue |

|||||

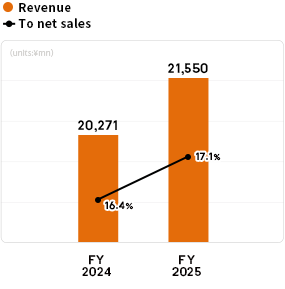

| Marketing Communication Segment | ー | ー | 20,271 | 21,550 | |

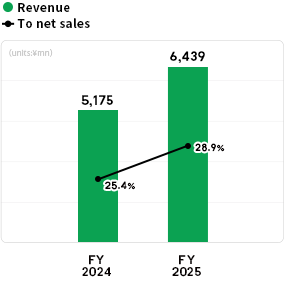

| Direct Business Segment | ー | ー | 5,175 | 6,439 | |

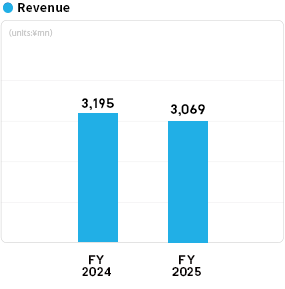

| Data & Solutions Segment | ー | ー | 3,195 | 3,069 | |

| Adjustment | ー | ー | -357 | -749 | |

| Consolidated | 27,589 | 34,267 | 28,284 | 30,309 | |

Non-GAAP operating profit |

|||||

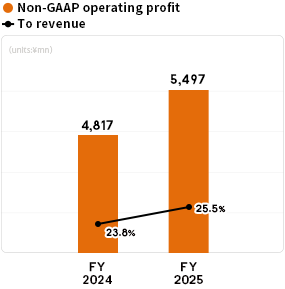

| Marketing Communication Segment | ー | ー | 4,817 | 5,497 | |

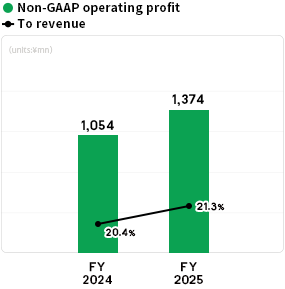

| Direct Business Segment | ー | ー | 1,054 | 1,374 | |

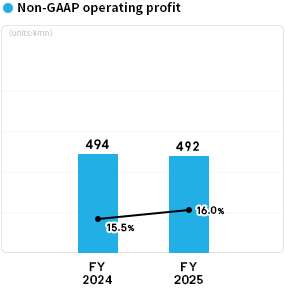

| Data & Solutions Segment | ー | ー | 494 | 492 | |

| Adjustment | ー | ー | ‐3,168 | -2,948 | |

| Consolidated | 6,565 | 5,091 | 3,197 | 4,414 | |

【Reference】Net sales |

|||||

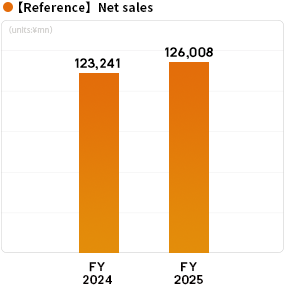

| Marketing Communication Segment | ー | ー | 123,241 | 126,008 | |

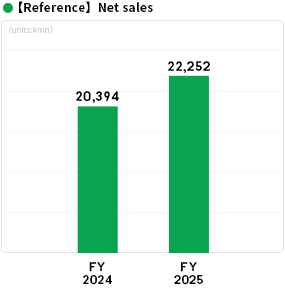

| Direct Business Segment | ー | ー | 20,394 | 22,252 | |

| Data & Solutions Segment | ー | ー | 3,195 | 3,069 | |

| Adjustment | ー | ー | ‐834 | -2,546 | |

| Consolidated | 130,205 | 169,719 | 145,996 | 148,783 |

*1 FY2023 is 15 months from October 1, 2022 to December 31, 2023 due to a change in the fiscal year-end.

*2 Since the fiscal year ended December 2025, the Company has changed its reportable segments to the "Marketing Communication Area," "Direct Business Area," and "Data & Solutions Area." Due to this change, retrospective restatements have been applied solely to FY2024, and only the consolidated figures are presented for FY2022 and FY2023.

Review of Marketing Communication Segment in Fiscal Year Ended December 2025

The Marketing Communication Segment provides comprehensive DX support through integrated marketing services centered on digital advertising sales and operations.

In the current fiscal year, the Company expanded existing projects and acquired new ones, while also promoting the alliance with the Dentsu Group. In addition, the revenue uplift from initiatives aimed at addressing its short-term challenges of improving profitability absorbed higher SG&A expenses, and both revenue and operating profit increased year on year. Revenue was ¥21,550 million (up 6.3% year on year), and Non-GAAP operating profit was ¥5,497 million (up 14.1% year on year).

* Since the reportable segments were changed in FY2025 and retrospective restatements were applied only to FY2024, the figures for each segment are presented for a two-year period.

Review of Direct Business Segment in Fiscal Year Ended December 2025

The Direct Business Segment provides integrated client support by seamlessly executing everything from business strategy planning to direct response promotions and CRM in both B2C and B2B areas, thereby unifying offline media and digital strategies.

In the current fiscal year, both revenue and Non-GAAP operating profit increased, driven by significant revenue growth, primarily from offline advertising projects. Revenue was ¥6,439 million (up 24.4% year on year), and Non-GAAP operating profit was ¥1,374 million (up 30.3% year on year).

* Since the reportable segments were changed in FY2025 and retrospective restatements were applied only to FY2024, the figures for each segment are presented for a two-year period.

Review of Data & Solutions Segment in Fiscal Year Ended December 2025

The Data & Solutions Segment leverages long-standing expertise in digital marketing to provide data collection, integration, and utilization services, develop and deliver data- and AI-driven solutions, support client development, and dispatch engineering personnel.

In the current fiscal year, revenue and Non-GAAP operating profit declined due to the roll-off of certain projects delivered in the previous nine months. Revenue was ¥3,069 million (down 3.9% year on year), and Non-GAAP operating profit was ¥492 million (down 0.4% year on year).

* Since the reportable segments were changed in FY2025 and retrospective restatements were applied only to FY2024, the figures for each segment are presented for a two-year period.