Corporate Governance

Basic Approach to Corporate Governance

The corporate governance of the Company and the company group comprising its subsidiaries (hereinafter called the “Group”) is based on the development and operation of a system to ensure that actions are based on the company’s corporate philosophy and decisions are made in a transparent, fair, and efficient manner, and compliance with laws and regulations and appropriate supervision (monitoring) of corporate performance are carried out under the mission of "To inspire the world with entrepreneurship".

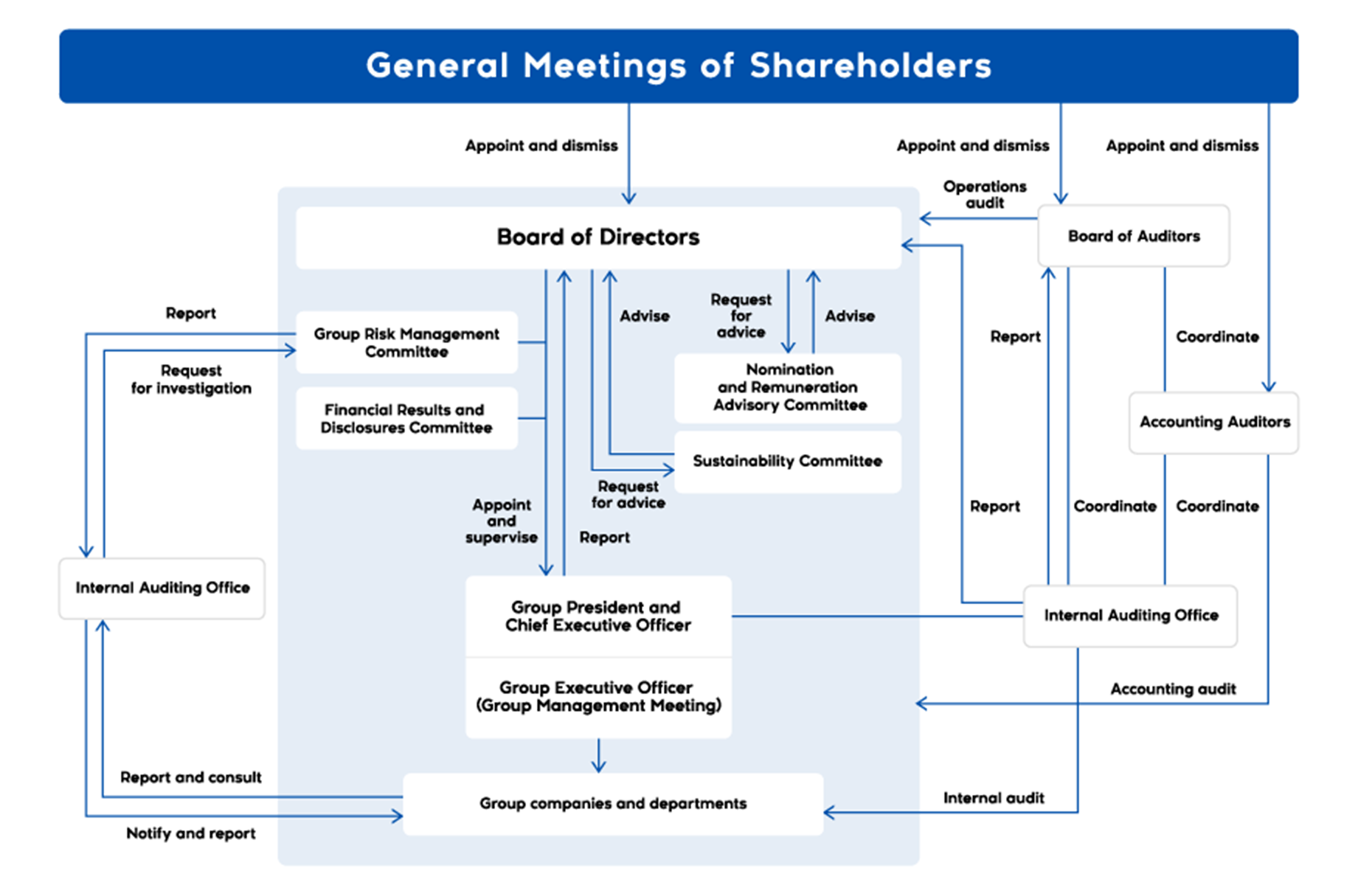

The Outline of Corporate Governance Structure

The Group is managed under a holding company structure in which the Company is a holding company and its group companies are operating companies. By separating the function of administering its overall business from executing its individual businesses, the Group has been working to facilitate the delegation of authority and strengthen the Company’s function of monitoring the Group’s businesses.

The Board of Directors

The Board of Directors shall consist of a majority, at the minimum, of highly independent Outside Directors. The Board currently consists of seven Directors, four of whom are Outside Directors. It determines matters prescribed by laws and regulations and the Articles of Incorporation and matters concerning the execution of important business and oversees the execution of business. Furthermore, as part of strengthening of its corporate governance system, the Company introduced an executive officer system in January 2017. Under this system, the authority for making decisions and executing business operation is delegated to Executive Officers (hereinafter, “Group Executive Officers”) to the extent permitted by relevant laws and regulations, in order for the Board of Directors to mainly focus on the oversight (monitoring) of the Group Executive Officers who are responsible for the execution of business (monitoring model- oriented).

The Group Executive Officers

The Group Executive Officers are responsible for the execution of business of the Company, that of the business companies in its group or that across several business companies. The Board of Directors appoints Group Executive Officers in charge of respective areas of business operation, and the Group President and Chief Executive Officer who concurrently serves as Representative Director oversees the execution of business operations by the Group Executive Officers.

Moreover, matters to be resolved by meetings of the Board of Directors, those regarding which authority is to be delegated to the Group Executive Officers and those to be reported by the Group Executive Officers to the Company’s Board of Directors are clearly stipulated in the regulations of the Board of Directors.

In addition to the above, Group Management Meeting has been established, as a system regarding decision-making on the execution of business, with the functions of supporting decision-making by the Group President and Chief Executive Officer and of considering important managerial matters of the group. The Company has also established a Group Risk Management Committee that supervises risk management of the group, a Sustainability Committee that promotes sustainability activities to enhance the corporate value and a Financial Results and Disclosures Committee that reviews and evaluates financial results information, information for timely disclosure, among other things. In doing so, the Company has put in place a system that clarifies authority and responsibilities and enables prompt and appropriate decision-making.

Nomination and Remuneration Advisory Committee

Nomination and Remuneration Advisory Committee, the majority of which consists of Outside Directors, has been established as an optional committee of the Board of Directors to handle personnel matters regarding the group’s management team (appointment, removal etc., of Directors of the Company, Group Executive Officers and others) and remuneration (individual remuneration, etc., for Directors of the Company, Group Executive Officers and others for the fiscal year) in order to ensure the independence, objectivity and accountability of the deliberation process.

<Activities in FY2024>

| Members | Number of committee members in attendance |

Attendance Rate |

|---|---|---|

| Etsuko Okajima(Chairperson/Vice-chairperson, Outside Director) | 5/5 (o/w 2 times as chairperson) | 100% |

| Yoshiki Ishikawa(Member/Chairperson, Outside Director) | 5/5 (o/w 3 times as chairperson) | 100% |

| Akie Iriyama (Outside Director) | 5/5 | 100% |

| Mio Takaoka (Outside Director) | 5/5 | 100% |

| Makoto Shiono (Outside Director) | 3/3 | 100%*1 |

| Yuichi Kouno (Representative Director) | 3/3 | 100%*1 |

| Yusuke Asakura (Outside Director) | 1/2 | 50%*2 |

| Koki Sato (Representative Director) | 2/2 | 100%*2 |

<Activities in FY2024>

| Members | Number of committee members in attendance |

Attendance Rate |

|---|---|---|

| Etsuko Okajima(Chairperson/Vice-chairperson, Outside Director) | 5/5 (o/w 2 times as chairperson) | 100% |

| Yoshiki Ishikawa(Member/Chairperson, Outside Director) | 5/5 (o/w 3 times as chairperson) | 100% |

| Akie Iriyama (Outside Director) | 5/5 | 100% |

| Mio Takaoka (Outside Director) | 5/5 | 100% |

| Makoto Shiono (Outside Director) | 3/3 | 100%*1 |

| Yuichi Kouno (Representative Director) | 3/3 | 100%*1 |

| Yusuke Asakura (Outside Director) | 1/2 | 50%*2 |

| Koki Sato (Representative Director) | 2/2 | 100%*2 |

*1 The attendance at the Nomination and Remuneration Advisory Committee meetings represents the attendance after their taking office on March 27, 2024.

*2 The attendance at the Nomination and Remuneration Advisory Committee meetings represents the attendance before their retiring from office on March 27, 2024.

Executive Session

Meetings attended only by the Outside Directors (Executive Session) are held once a month in principle, thereby securing a place for information exchange and shared awareness from objective standpoints. Outside Auditors, external accounting auditors and other independent outside persons may attend such meetings, thereby providing a place for promoting cooperation among independent outside persons.

Company auditor system

The Company has adopted a company auditor system. Under the system, there are currently four Company Auditors including three highly independent Outside Auditors. Each Company Auditor audits the execution of business by the Directors, in accordance with the auditing policy, audit plans and so forth determined by the Board of Company Auditors.

Corporate Governance System

Progress of Governance Reforms

- Fiscal Year

Ended September 2015 -

- Systematization of governance for greater effectiveness

- Increased to two

(including a female director)

- Fiscal Year

Ended September 2016 -

- Introduction of effectiveness evaluation to enhance the functioning of the Board of Directors

- Establishment of the Financial Results and Disclosures Committee and the CSR Committee

- Abolition of anti-takeover measures

- Establishment of Group Risk Management Committee

- Fiscal Year

Ended September 2017 -

- Introduction of performance-linked stock compensation system for officers

- Seperation of execution and monitoring through the introduction of an entrustment-type executive system

-

Outside directors become

the majority of

the Board of Directors

- Fiscal Year

Ended September 2018

- Fiscal Year

Ended September 2019

Governance Highlights

(Fiscal year ended December 2024)

- Number of Directors

(Outside Directors Included in Total) - 7(4)

- Number of Board of Directors' Meeting Held

- 11

- Average Attendance Rates at Borad of Directors' Meetings

Directors - 99%

- Auditors

- 100%

- Number of Auditors

(Outside Auditors Included in Total) - 4(3)

- Number of Borad of Auditors' Meetings Held

- 14

- Average Auditor Attendance Rate at Board of Auditors' Meetings

- 100%

Evaluation of the Effectiveness of the Board of Directors

With the aim of enhancing the function of the Board of Directors, the Company conducts analysis, evaluation and follow-up examinations of issues on the effectiveness of the Board of Directors once a year in principle. The Company also conducts large-scale and detailed surveys by external third-party institutions once every 3 years. In the fiscal year ended December 2024, the Company renewed its management structure following a resolution at the March 2024 General Meeting of Shareholders. This followed the recommendations of the Nomination and Remuneration Advisory Committee, which had engaged in extensive discussions on succession planning to achieve sustainable growth, and the resolution of the Board of Directors . Under the new management structure, the Company held discussions at the Board of Directors meetings, executive training camps, and other forums on measures to promote value co-creation between supervision and execution, as well as on the Group's medium- to long-term strategies. Specifically, the Company continued discussions on its business portfolio and business continuity criteria, revised its dividend policy, and established and revised various internal rules and regulations.

The Company’s Board of Directors engages in sophisticated and active discussions. Furthermore, on the operational side, the Company have already implemented necessary and sufficient practical measures, including refining the Board's agenda, providing materials in advance, creating opportunities for discussion through camps, and strengthening collaboration among outside directors through executive sessions, thereby ensuring effectiveness. Going forward, the Company will continue to strive to enhance corporate value and further improve the effectiveness of the Board of Directors.

Officer Compensation Plan

In September 2017, the Group introduced a new compensation plan (a board incentive plan (BIP) trust) to more clearly define the relationship between the remuneration of the Company’s directors (excluding outside directors and non-residents of Japan) and executive officers (excluding non-residents of Japan; collectively, “Directors, etc.”) and the Group’s business results in the medium-to-long term as well as the Company’s shareholder value, while creating a sound incentive to enhance business results and corporate value in the mediumto-long term. As a result, remuneration for directors of the Company consists of monthly compensation and stock compensation, and remuneration for outside directors who are independent from business execution consists of monthly compensation only.

BIP Trust

This is a performance-linked stock compensation plan that aims to establish a clearer relationship between remuneration for Directors, etc. and the value of the Group’s stock. The Company's shares are purchased from the market as officer compensation, kept in a trust account and delivered in accordance with the recipient’s position and degree of achievement of the performance targets in the Midterm Business Policies.

- 2016.11.22 Notice Regarding Adoption of Performance-Based Stock Compensation Plan for OfficersPDF638KB

- 2019.11.26 Notice Regarding Continuation of Performance-Linked Stock Compensation Plan for OfficersPDF638KB

- 2022.11.26 Notice on the Continuation and Partial Revision of the Performance-Linked Stock Compensation Plan for Directors and OfficersPDF638KB

- 2023.4.25 Notice of Change in Share Acquisition Period under Performance-Linked Stock Compensation Plan for Directors and OfficersPDF125KB

Director and Auditor Remuneration

Fiscal year ended December 2024 (units:thousand yen)| Category | Number of payees | Total amount of officers’ remunerations, etc. | Total amount of remunerations, etc. by type | |

|---|---|---|---|---|

| Basic remuneration | Performance-linked remuneration, etc. | |||

| Non-monetary remuneration, etc. | ||||

| Director (of which Outside Director) |

9 (6) |

224,289 (¥77,400) |

224,289 (¥77,400) |

- (¥–) |

| Company Auditor (of which Outside Company Auditor) |

3 (3) |

24,000 (¥24,000) |

24,000 (¥24,000) |

- (¥–) |

| Category | Number of payees | Total amount of officers’ remunerations, etc. | Total amount of remunerations, etc. by type | |

|---|---|---|---|---|

| Basic remuneration | Performance-linked remuneration, etc. | |||

| Non-monetary remuneration, etc. | ||||

| Director (of which Outside Director) |

6 (5) |

261,066 (¥90,000) |

254,670 (¥90,000) |

6,396 (¥– thousand) |

| Company Auditor (of which Outside Company Auditor) |

3 (3) |

30,000 (¥30,000 ) |

30,000 (¥30,000) |

- (¥–) |

Notes:

- The number of payees and the amount of remunerations include two directors and the amount of remuneration during their service, who retired from office at the conclusion of the 33rd Ordinary General Meeting of Shareholders held on March 27, 2024.

- In addition to the remunerations above, ¥2,250 thousand was paid as retirement benefits to one director who retired from office at the conclusion of the 33rd Ordinary General Meeting of Shareholders held on March 27, 2024, based on the resolution to pay accrued retirement benefits in connection with the termination of the retirement benefits program for directors and company auditors approved at the 13th Ordinary General Meeting of Shareholders held on December 18, 2003.

- The total amount of officer’s remunerations etc., total amount of remunerations, etc. by type., and the number of eligible officers do not include two directors and one company auditor all of whom serve without remuneration.

- The Company is introducing a performance-linked share-based remuneration system using the directors’ remuneration BIP (Board Incentive Plan) trust scheme for directors of the Company (excluding outside directors and those who are nonresidents of Japan). Covenants, etc. at the time of allotments are provided in “(a) Policy for determining details of remunerations, etc. for officers,” and the delivery status in the business year under review is provided in “2. (1) 5) Status of shares delivered to the Company’s officers as remuneration for the execution of duties during the business year under review.”

- The performance indicator associated with performance-linked remuneration, etc. is consolidated Non-GAAP operating profit, and those results are provided in “1. (1) Business progress and results,” and “1. (2) Trends in financial position and profit and loss.” As the reason for selecting this indicator, the Company has deemed that this is an appropriate indicator for evaluating the achievement of improvements to the medium- to long-term corporate value. In calculating performance-linked remuneration, basic points are allotted in a set period during each business year according to the role of each director and the level of achievement, etc. of performance targets during the covered trust period of the directors’ remuneration BIP trust. After the conclusion of the covered period, additional points allotted to persons covered by the system on the last day of the final business year of the covered period are cumulatively added to the cumulative value of basic points (“Cumulative

Points”).

A number of the Company’s shares equal to the number of Cumulative Points is delivered or paid to persons covered by the system as share-based remuneration. Furthermore, 50% of the shares corresponding to the points in question (share of less than one unit rounded down) will be delivered as shares, and from the standpoint of securing funds to pay taxes, the remainder will be converted into cash, and cash corresponding to the amount converted to cash will be paid. - At the 23rd Ordinary General Meeting of Shareholders held on December 20, 2013, the amount of cash remuneration for directors was set at up to ¥600 million annually (not including the portion of employee salaries paid to directors concurrently serving as employees). The number of directors as of the conclusion of this ordinary general meeting of shareholders is eight.

Furthermore, in a separate framework from cash remuneration, at the 26th Ordinary General Meeting of Shareholders held on December 20, 2016, the amount of trust funds provided to the trust as funds for the acquisition of the Company’ shares associated with the points allotted to directors (excluding outside directors and non-residents of Japan) as performancelinked share-based payments (directors’remuneration BIP trust) was set at a maximum of ¥700 million, and the total points at a maximum of 2,800,000 points (corresponding to 2,800,000 shares) for three business years. The number of directors as of the conclusion of this ordinary general meeting of shareholders (excluding outside directors and non-residents of Japan) is six.

At the 32nd Ordinary General Meeting of Shareholders held on December 21, 2022, resolutions were passed to extend the trust period until May 31, 2026, and in conjunction with the change in the Company’s fiscal year-end, to continue with the plan under a new version in which some details were revised. The number of directors as of the conclusion of this ordinary general meeting of shareholders (excluding outside directors and non-residents of Japan) is two. - The amount of cash remuneration for company auditors was set at a maximum of ¥50 million annually at the 9th Ordinary General Meeting of Shareholders held on December 14, 1999. The number of company auditors as of the conclusion of this ordinary general meeting of shareholders is one.

- The board of directors has delegated the decisions on the amounts of individual director remuneration to Koki Sato, the former Representative Director, Group President and Chief Executive Officer. The reason for the delegation is that the board of directors deemed that the Representative Director, Group President and Chief Executive Officer is best suited to conduct evaluations of the division for which each director is responsible while considering the Company’s overall performance, etc. The decisions on the delegated matters are made while referencing the proposed recommendations of the Nomination and Remuneration Advisory Committee to confirm the validity of remuneration levels.

Reasons for Appointment of Directors

The reasons are described on the Our Executives page.