Response to Climate Change

Desired State

Climate change is threatening the future of our planet. Given that a sustainable and sound Earth and society are prerequisites for business operations, addressing climate change is of high importance and is also widely demanded by society and stakeholders. By continuously taking action against climate change, we aim to achieve a decarbonized society.

| Subcategory of Materiality | KPI | Target | Target Achievement Timing |

Relevance to corporate value |

|---|---|---|---|---|

| Reduction of GHG emissions and disclosure of information in accordance with TCFD recommendations | Scope 1 & 2 emissions | 70% reduction | 2030 | ・Mitigation of management risks ・Mid- to long-term value creation |

Disclosure of information in accordance with TCFD recommendations

Given that a sustainable and sound Earth and society are prerequisites for business operations, we recognize the high importance of addressing climate change and have identified it as a materiality.

Against this backdrop, we endorsed the Task Force on Climate-related Financial Disclosures (TCFD) recommendations in October 2023 and have implemented information disclosure based on the TCFD framework.

1. Governance

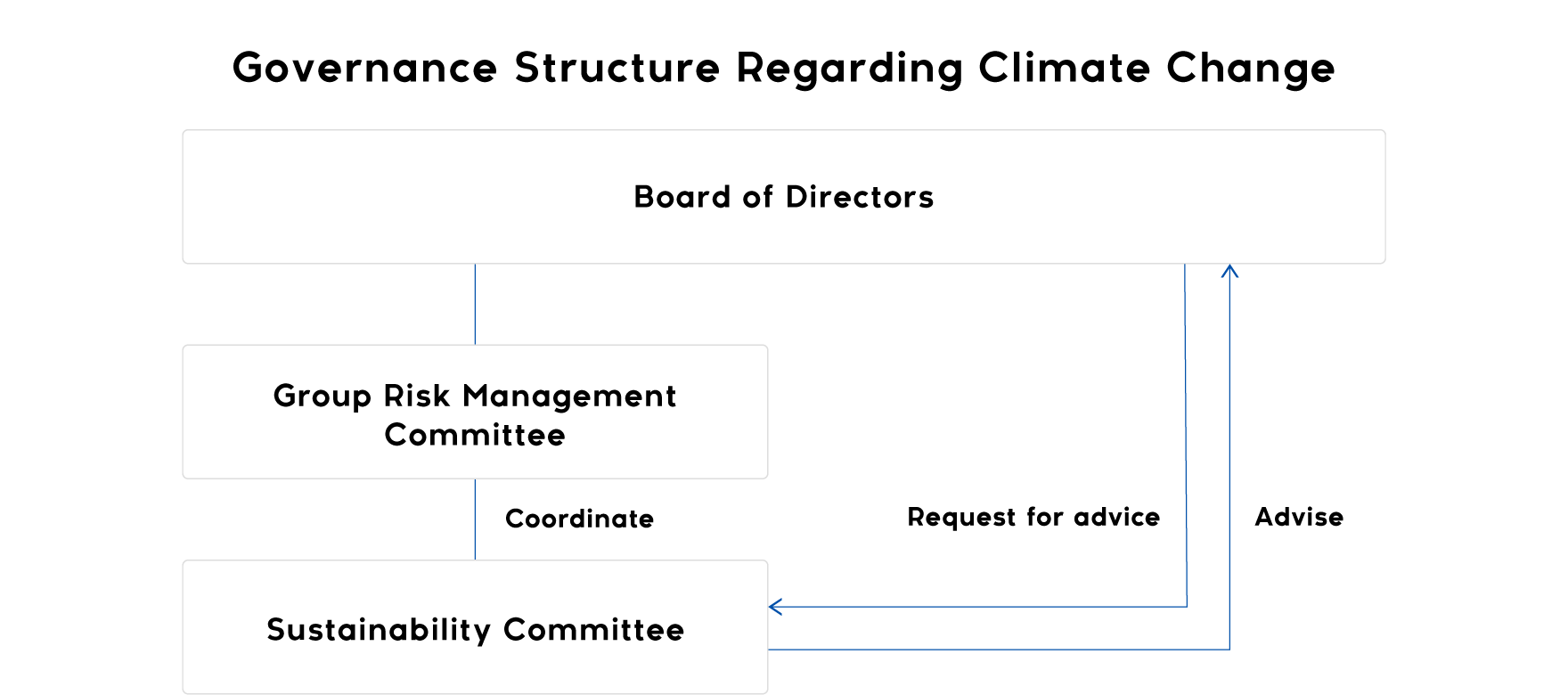

As an advisory body to the Board of Directors, the Sustainability Committee, chaired by the Group CEO, discusses and examines sustainability activities and climate-related issues. The committee’s activities are regularly reported to the Board of Directors, and resolutions are sought at the Board of Directors for particularly important themes.

(Note)The image is an excerpt from the governance structure diagram.please refer to the full diagram below.

https://www.septeni-holdings.co.jp/en/company/governance.html

2. Strategy

We recognize the risks, measures, and opportunities brought about by climate change as follows at the present time.

In scenario analysis*, we assumed a world with a temperature rise of 2°C and 4°C, and evaluated the importance of climate-related risks and opportunities that could potentially impact our business.

We aim to enhance resilience by mitigating risks and expanding opportunities.

*In scenario analysis, we refer to reports from the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA), etc.

| Classification of Risks and Opportunities based on TCFD Recommendations | Assumed Main Risks and Opportunities | Response | Impact Level | Occurrence Time | |

|---|---|---|---|---|---|

| Transition Risks | Policy/Legal | Costs arising from carbon taxes, etc. | Transition to renewable energy | Medium | Short to medium term |

| Technology | Increased costs due to delays in adapting to low-carbon technologies | Rapid conversion to energy-efficient equipment | Small | Medium to long term | |

| Market | Increased costs due to rising electricity prices | Promotion of energy conservation through educational activities for employees | Small | Short to long term | |

| Reputation | Loss of trust from clients, investors, and employees and decrease in corporate value due to delays in climate change measures | Disclosure through TCFD, CDP, etc. | Medium | Medium to long term | |

| Physical Risks | Acute | Operational stoppage of services and impact on internal infrastructure due to intensification of abnormal weather and frequent natural disasters | Maintenance and enhancement of BCP and crisis management systems | Large | Long term |

| Self-restraint/reduction in advertising due to disasters | Promotion of proactive initiatives to realize a decarbonized society | Large | Long term | ||

| Chronic | Increased costs for air conditioning, etc. due to changes in weather patterns | Implementation of ongoing energy conservation measures in offices | Small | Medium to long term | |

| Opportunities | Products/Services | Acquisition of new business opportunities due to major changes in industry and society | Acquisition of new clients emerging from the promotion of decarbonization | Small | Medium to long term |

| Market | Increase in advertising due to expanding demand for environmentally friendly products/services | Small | Medium to long term | ||

| Resilience | Changes in work styles due to dispersion of residences accompanying changes in weather patterns | Promotion of diverse work styles through remote work | Medium | Short to long term | |

*Short-term: to 2025, Mid-term: 2025 to 2030, Long-term: 2030 to 2050

3. Risk Management

The Sustainability Promotion Department, which serves as the secretariat for the Sustainability Committee, evaluates and determines the importance of risks and opportunities related to climate change based on their impact on our businesses. In the evaluation, we conduct hearings with related Group companies and departments as necessary.

We have established the “Group Risk Management Rules” in order to recognize significant events that affect our business management, identifies, analyzes,and evaluates risks that hinder the development and growth of our business, and implement measures such as risk avoidance, reduction, and transfer. Furthermore, under the common policy of our Group, we have established the Group Risk Management Committee as an institution to oversee and manage risk management activities in an integrated and effective manner. We are building a PDCA cycle of risk management activities and working on promoting risk management throughout the Group to achieve sustainable growth. We are also working on promoting risk management in collaboration with the Group Risk Management Committee and the Sustainability Committee in order to manage risks related to climate change in an integrated manner with other risks of the Group.

4. Metrics and Targets

At Septeni Group, we have set a goal to reduce the GHG emissions of Scope 1+2 by 70% by fiscal year 2030 compared to fiscal year 2023. The actual GHG emissions are as follows.

In the fiscal year ended December 2024, Scope 1 emissions decreased due to a change in category reflecting changes in the usage frequency of company vehicles. Scope 2 emissions were reduced by implementing renewable energy at some group company sites including the headquarters office, and switching to LED lighting at the head office.

Scope 3 emissions, however, increased due to a rise in business travel and commuting associated with the promotion of hybrid work styles combining remote and office work, as well as the renovation of the headquarters office, which led to increased emissions in the relevant department.

Going forward, we will consider initiatives aimed at reducing emissions, such as transitioning to renewable energy and trading environmental certificates.

| 2020/9 | 2021/9 | 2022/9 | 2023/12*3 | 2024/12 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Emissions (t-CO2) |

Ratio (%) |

Emissions (t-CO2) |

Ratio (%) |

Emissions (t-CO2) |

Ratio (%) |

Emissions (t-CO2) |

Ratio (%) |

Emissions (t-CO2) |

Ratio (%) |

|

| Scope 1 | 5.5 | 0.1 | 6.9 | 0.1 | 7.3 | 0.1 | 7.0 | 0.1 | 0.0 | 0.0 |

| Scope 2*1 | 768.5 | 15.9 | 719.6 | 14.8 | 817.0 | 12.8 | 940.6 | 9.1 | 513.3 | 6.4 |

| Total for Scopes 1 and 2 | 774.0 | 16.0 | 726.5 | 14.9 | 824.3 | 12.9 | 947.6 | 9.2 | 513.3 | 6.4 |

| Scope 3*2 | 4,071.1 | 84.0 | 4,138.1 | 85.1 | 5,548.6 | 87.1 | 9,386.9 | 90.8 | 7,536.9 | 93.6 |

| Total | 4,845.1 | 4,864.6 | 6,372.9 | 10,334.5 | 8,050.3 | |||||

*1 Scope 2 emissions are calculated using the market-based method.

*2 Category 1 (Purchased goods & services), Category 2 (Capital goods),Category 3 (Fuel & energy-related activities), Category 6 (Business travel), Category 7 (Employee commuting), Category 8 (Leased assets (upstream))

*3 Due to the fiscal-year change, the figures in 2023 show the amount for 15 months.

▼Please refer to the link below for a detailed breakdown of GHG emissions.

Environmental Activities

To contribute to achieving a sustainable society, the Septeni Group will actively work to reduce the environmental impact of its business activities and will use resources efficiently.

Environmental Policy

| 1. Reduction of printing paper |

| 2. Proactive green purchasing |

| 3. Implementation of resource and energy saving measures and promotion of recycling |

Efforts to Reduce Printing Paper

With our shift to a hybrid work model that combines offline and online operations, we have promoted the digitalization of meeting materials and internal documents. As a result, a "paperless" workflow has become our standard business style. Consequently, we have significantly reduced our paper consumption compared to FY2019. We will remain committed to thorough paperless operations and continue our efforts to reduce our environmental impact.

Adoption of LIMEX (a limestone-based material) for Business Cards

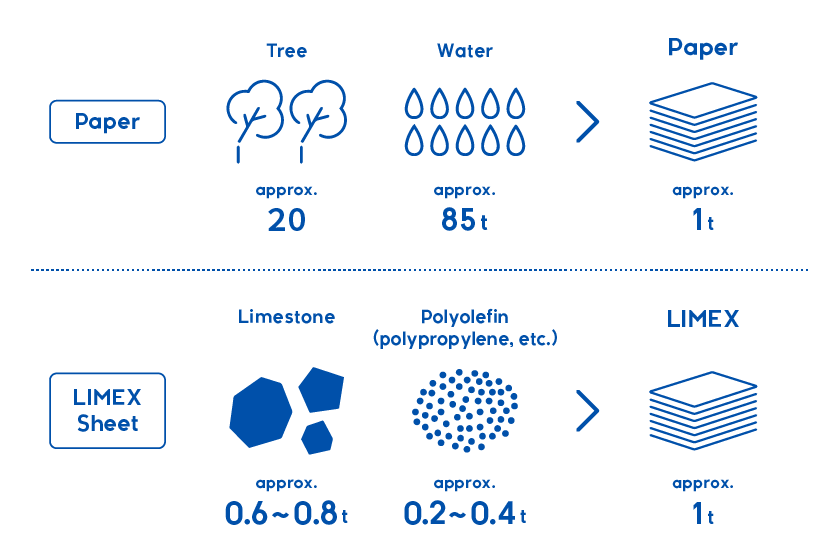

LIMEX is a new material primarily composed of limestone, developed by TBM Co., Ltd. It has attracted attention in recent years amid increasing environmental conservation efforts, as it allows for the production of alternative materials to paper and plastic without using petroleum-derived materials or wood.

At Septeni Group, we have been using LIMEX for our business cards since 2019. By using LIMEX business cards, we can produce one ton of paper alternative without requiring approximately 20 trees and about 85 tons of water, as is typically the case with conventional paper production methods, since LIMEX requires neither wood nor water.

Efforts to Reduce Plastic Bottle Usage

In 2021, we switched the drinking water for visitors from plastic bottles to aluminum cans. By adopting aluminum cans, which have a high recycling rate and less energy use during reproduction, we are striving to reduce environmental impact.

One Day for Change

We participate in "One Day for Change," an event conducted by dentsu Japan to deepen each individual's awareness and learning regarding social issues, in order to "generate ideas for the future that solve difficult social challenges" through business.

In 2023 and 2024, we conducted litter-picking activities around our offices, and in 2025, we held an in-office giveaway event for second-hand clothes and books. These activities strengthen connections within the Group and raise awareness of environmental issues.