Shareholder Return

Shareholder Return Policy

Regarding dividends of surplus, in consideration of our consolidated earnings performance of each fiscal year, the strengthening of our financial position, the Group's business strategy going forward and other factors, we endeavor to return profits to shareholders within the range of our distributable amount, with a dividend payout ratio of 100% to profit attributable to owners of parent for the fiscal year ending December 2024 and a minimum dividend payout ratio of 50% from the fiscal year ending December 2025 onward.

We also intend to acquire own shares on an ongoing basis by comprehensively taking into account market conditions, opportunities to invest in businesses, capital efficiency, the level of share price, etc. and to implement such share repurchases in a flexible manner.

Retained earnings will be used for investments in high-growth and profitable business domains, as well as for investments to improve the efficiency and vitalization of existing businesses, and for educational investment to develop human resources.

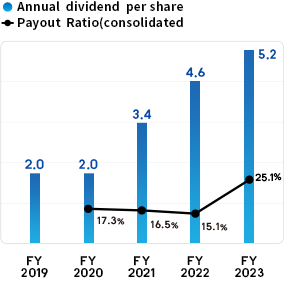

Trend of Actual Dividend

| FY2019 | FY2020 | FY2021 | FY2022 | FY2023 | |

|---|---|---|---|---|---|

| Annual dividend per share (After adjustment of stock split) |

2.0 Yen | 2.0 Yen | 3.4 Yen | 4.6 Yen | 5.2 Yen |

| Payout ratio (consolidated) | - | 17.3% | 16.5% | 15.1% | 25.1% |

Acquisition of Own Shares

| Acquisition period | Number of shares acquired (shares) |

Total amount (thousand yen) |

|---|---|---|

| From Feb. 17, 2023 to Mar. 17, 2023 | 2,200,000 | 748,485 |

| From Nov. 24, 2016 to Dec. 2, 2016 | 1,800,000 | 630,452 |

| Dec. 22, 2009 | 2,075 | 66,918 |

| From Apr. 1, 2009 to May 29, 2009 | 4,604 | 159,206 |

| From Jul. 19, 2006 to Aug. 1, 2006 | 1,000 | 137,429 |

| From Sep. 14, 2005 to Sep. 30, 2005 | 894 | 248,455 |

| From Oct. 21, 2004 to Oct. 31, 2004 | 189 | 879 |

| From Apr. 15, 2002 to Dec. 19, 2002 | 803 | 133,114 |